Have you heard the exciting news? Apple Card, the popular credit card from tech giant Apple, has just launched a new feature that is sure to captivate the attention of its users – a high-yield savings account! This latest offering is designed to provide Apple Card holders with an attractive opportunity to grow their savings while taking advantage of a competitive annual percentage yield (APY) of 4.15%. Let’s dive deeper into this exciting development and explore the features, benefits, and security measures of Apple Card’s new savings account.

Features of Apple Card’s Savings Account

Apple Card’s high-yield savings account comes packed with features that are sure to delight users looking to optimize their savings. One of the standout features is the impressive APY of 4.15%, which is significantly higher than the national average for traditional savings accounts. This means that Apple Card users have the potential to earn more interest on their savings, helping them to reach their financial goals faster.

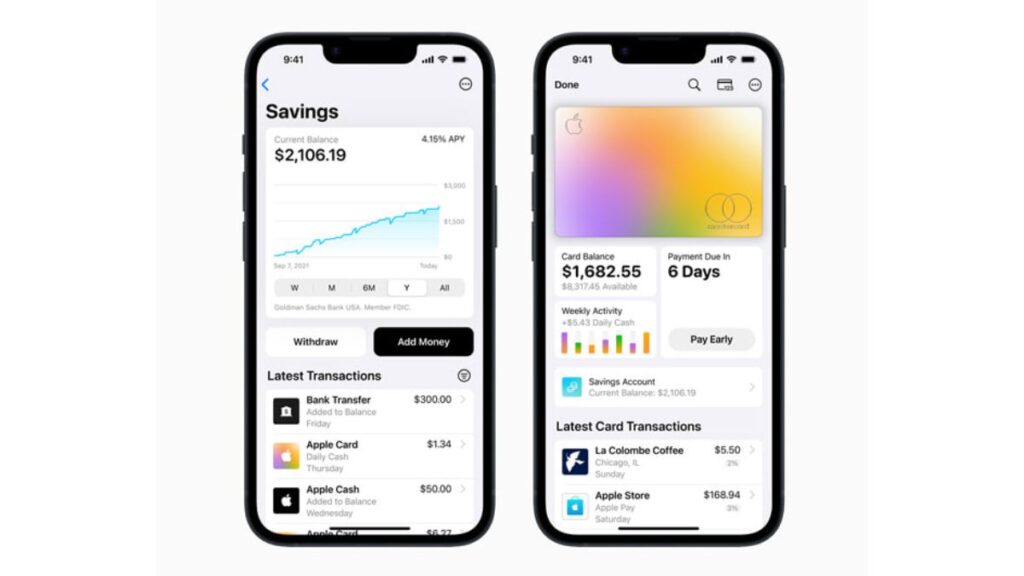

In addition to the competitive APY, Apple Card’s savings account also offers seamless integration with the Apple Wallet app, making it easy for users to manage their savings alongside their credit card transactions. The account also boasts no minimum balance requirement, no monthly fees, and no hidden charges, making it a transparent and user-friendly option for those looking to save without any surprises.

Benefits of Apple Card’s Savings Account

Apple Card’s new savings account comes with a host of benefits that make it an attractive option for users looking to grow their savings. One of the key advantages is the convenience and accessibility offered by the integration with the Apple Wallet app. Users can easily track their savings, set savings goals, and transfer funds between their credit card and savings account with just a few taps on their iPhones.

Another significant benefit of Apple Card’s savings account is the high APY of 4.15%, which is much higher than the average interest rate offered by traditional savings accounts. This means that users have the potential to earn more interest on their savings, helping them to maximize their savings and grow over time. With Apple Card’s savings account, users can watch their savings grow faster than ever before, bringing them closer to achieving their financial goals.

How to Access Apple Card’s Savings Account

Accessing Apple Card’s high-yield savings account is easy for existing Apple Card users. Simply update your Apple Wallet app to the latest version and navigate to the “Card” tab. From there, you can easily enroll in the savings account and start taking advantage of the competitive APY and other features. If you don’t have an Apple Card yet, you can apply for one directly from the Wallet app and take advantage of the savings account once your application is approved.

Comparison with Other Savings Accounts

When it comes to comparing Apple Card’s savings account with other traditional savings accounts, the differences are clear. The most significant advantage of Apple Card’s savings account is the high APY of 4.15

In conclusion, Apple Card’s new high-yield savings account is a beacon of opportunity for those seeking to grow their savings with a touch of modern magic. With its impressive features, attractive benefits, and unwavering commitment to security, it’s a treasure trove for savvy savers looking to embark on a journey toward financial success. So don’t miss out on this golden chance, and let your savings bloom and flourish with Apple Card’s savings account, the epitome of simplicity, convenience, and prosperity!

Frequently Asked Questions (FAQs)

Q: Can I really earn 4.15% APY with Apple Card’s savings account? It sounds too good to be true!

A: Yes, indeed! Apple Card’s new high-yield savings account offers an incredibly competitive APY of 4.15%, allowing you to watch your savings bloom and thrive like a fragrant flower in springtime. It’s a golden opportunity to make your money work harder for you, and it’s no mirage, but a real treasure trove for savvy savers!

Q: Is there a minimum balance requirement for Apple Card’s savings account?

A: Fear not, for Apple Card’s savings account is a realm of no restrictions! There is no minimum balance requirement, giving you the freedom to save as much or as little as you desire. You can start your savings journey with a single petal, and watch it blossom into a bountiful bouquet of financial success!

Q: How can I manage my Apple Card savings alongside my credit card transactions?

A: Apple Card’s savings account brings the power of simplicity to your fingertips! With seamless integration with the Apple Wallet app, you can easily keep track of your savings, set goals, and transfer funds between your credit card and savings account with a gentle touch, as graceful as a butterfly’s dance. It’s a harmonious symphony of convenience and control!

Q: Is my personal information safe with Apple Card’s savings account?

A: Apple Card leaves no stone unturned when it comes to safeguarding your financial well-being. Your personal information and transaction data are protected by layers of security measures as sturdy as a fortress. Apple Card’s commitment to privacy and security is unwavering, ensuring that your savings are guarded like a precious gem, shining with confidence!

Q: Can I apply for an Apple Card if I don’t have one yet?

A: Absolutely! If you haven’t yet experienced the wonder of Apple Card, you can apply directly from the Wallet app and embark on a journey of financial empowerment. The application process is as smooth as a gentle breeze and once approved, you can unlock the full potential of Apple Card’s savings account and set sail on a voyage towards financial prosperity!

Thank you for your good blog종로노래방알바

Thank you for your good blog종로노래방알바

After study a few of the blog posts on your web site now, and I truly like your means of blogging. I bookmarked it to my bookmark web site list and will probably be checking again soon. Pls check out my site as properly and let me know what you think.

Thanks for visiting my site. I also checked on your site and you have done a great job.

Aw, this was a very nice post. In idea I would like to put in writing like this moreover ?taking time and actual effort to make a very good article?however what can I say?I procrastinate alot and by no means appear to get one thing done.

Thanks for your strategies. One thing we have noticed is the fact that banks along with financial institutions are aware of the spending behaviors of consumers and also understand that most of the people max away their cards around the holiday seasons. They correctly take advantage of that fact and start flooding your own inbox plus snail-mail box together with hundreds of no interest APR card offers soon after the holiday season closes. Knowing that if you are like 98 of the American general public, you’ll jump at the possiblity to consolidate personal credit card debt and transfer balances for 0 annual percentage rates credit cards.